Are you having a credit issue dispute? Has something been reported to your credit incorrectly or fraudulently to the credit bureaus? Call to talk to a Tampa credit dispute attorney today for a free consultation. Know your rights and speak to an attorney for credit, credit repair, credit disputes and any issues related to the credit bureaus.

Credit Report Disputes

Have you paid off a debt and it still appears on your credit report? Have you settled your debt and the credit bureaus will not remove the items from your credit? Are past due, late charges, and other erroneous items affecting your credit? Is your student loan balance not being reported correctly from creditors such as Navient? Have you received a paid in full letter and items still not removed from your credit bureau report? Have you gone through bankruptcy and the credit report and credit bureaus not accurately reflecting your information timely?

Credit Bureau Reporting and the FCRA

Credit Reporting and Credit Scoring Scheme

A credit history is a record of a consumer’s repayment of debts (including credit cards, mortgages, notes, rent, insurance, utilities, child support, etc.).

A credit report is a record of the consumer’s credit history from a number of sources (including banks, credit card companies, collection agencies, note holders, and governments).

- Pursuant to the FCRA, a “consumer report” is “any written, oral, or other communication of any information by a consumer reporting agency bearing on a consumer’s credit worthiness, credit standing, credit capacity,

character, general reputation, personal characteristics, or mode of living which is used or expected to be used or collected in whole or in part for the purpose of serving as a factor in establishing the consumer’s eligibility for (1) credit or insurance to be used primarily for personal, family, or household purposes, or (2) employment purposes, or (3) other purposes authorized under the FCRA.” 15 U.S.C. Section 1681a(d).

A credit reporting agency is any “person which, for monetary fees, dues, or on a cooperative nonprofit basis, regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information or other information on consumers for the purpose of furnishing consumer reports to third parties, and which uses any means or facility of interstate commerce for the purpose of preparing or furnishing consumer reports.” 15 U.S.C. Section 1681a(f).

- The three major credit reporting agencies (CRAs) are Experian, Equifax, and TransUnion.

Creditors subscribe to the CRAs to become Data Furnishers, thus enabling the sharing of billions of pieces of information each month on nearly every adult in the country. Importantly, therefore, the Data Furnishers (i.e., creditors, banks, note holders) are the CRA customers, not consumers. Data furnishers pay billions each year to provide the backbone of the credit reporting scheme.

A consumer’s credit score is the numerical result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency.

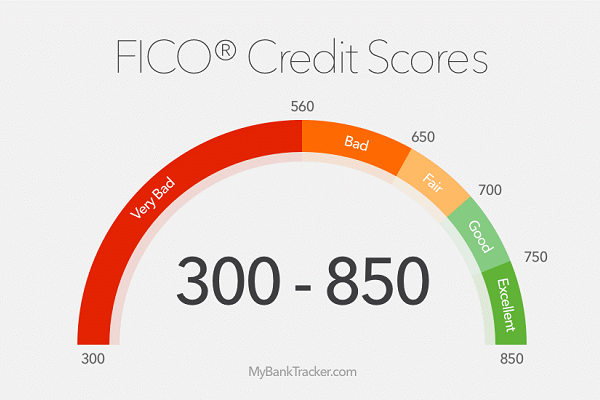

- The most widely used credit scores are FICO® Scores, the credit scores created by Fair Isaac Corporation. 90% of top lenders use FICO® Scores to help them make billions of credit-related decisions every year. FICO® Scores are calculated based solely on information in consumer credit reports maintained at the credit reporting agencies. General composition of most credit scores:

FCRA Framework

The FCRA is the Fair Credit Reporting Act, codified at 15 U.S.C. Section 1681 et seq. Congress originally enacted the FCRA in 1970 and made certain findings and a statement of purpose:

- The banking system is dependent upon fair and accurate credit reporting. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.

- An elaborate mechanism has been developed for investigating and evaluating the credit worthiness, credit standing, credit capacity, character, and general reputation of consumers.

- Consumer reporting agencies have assumed a vital role in assembling and evaluating consumer credit and other information on consumers.

- There is a need to insure that consumer reporting agencies exercise their grave responsibilities with fairness, impartiality, and a respect for the consumer’s right to privacy.

- It is the purpose of this title to require that consumer reporting agencies adopt reasonable procedures for meeting the needs of commerce for consumer credit, personnel, insurance, and other information in a manner which is fair and equitable to the consumer, with regard to the confidentiality, accuracy, relevancy, and proper utilization of such information in accordance with the requirements of this title.

Under the Fair and Accurate Credit Transactions Act (FACTA), an amendment to the FCRA passed in 2003, consumers may receive a free copy of their consumer report from each credit reporting agency once a year. The free report can be requested by telephone, mail, or through the government-authorized website: www.annualcreditreport.com.

Users of the information for credit, insurance, or employment purposes (including background checks) have the following responsibilities under the FCRA:

- Users can only obtain consumer reports for permissible purposes under the FCRA;

- Users must notify the consumer when an adverse action is taken on the basis of such reports; and,

- Users must identify the company that provided the report, so that the accuracy and completeness of the report may be verified or contested by the consumer.

Permissible Purposes of Consumer Reports:

- In response to a Court order or subpoena;

- In accordance with the written instructions of the consumer to whom it relates; or

- To a person a CRA has reason to believe intends to use the report: in connection with extending credit or to review or collect an account; for employment purposes; to determine underwriting of insurance; to determine eligibility for a license or other government benefit; or otherwise has a legitimate business need for the information.

FCRA Regulations and Requirements

Reporting of obsolete information – CRAs may only report:

- Bankruptcy information for 10 years (from date of discharge, if adjudicated, or filing, if dismissed).

- Judgments for 7 or years or the timeframe determined by the governing statute of limitations, whichever is longer.

- Tax liens for 7 years.

- Collections and Charge-Off accounts for 7 years.

- Arrests, indictments, or convictions for 7 years.

- Any other negative information for 7 years

Adverse Action Notices

- Two federal laws—the Equal Credit Opportunity Act (ECOA), as implemented by Regulation B, and the FCRA—reflect Congress’s determination that consumers and businesses applying for credit should receive notice of the reasons a creditor took adverse action on the application or on an existing credit account.

- Notice is also required under the FCRA for adverse actions taken with respect to insurance transactions, employment decisions, and in certain other circumstances.

Compliance Procedures

- CRAs

- Whenever a consumer reporting agency prepares a consumer report it shall follow reasonable procedures to assure maximum possible accuracy of the information concerning the individual about whom the report relates. 15 U.S.C. Section 1681e(b).

- Whenever a consumer disputes information to a CRA, the CRA must:

- Perform a reasonable re-investigation.

- Communicate the dispute to the Data Furnisher/Creditor.

- Review all information provided by the consumer.

- If information is found to be inaccurate or can no longer be verified, the CRA must delete the information.

- Note an account/tradeline as disputed in subsequent credit reports.

- Report the results of the re-investigation within 30 days (or 45, if a consumer used a free credit report to initiate the dispute).

FCRA Regulations and Requirements cont.

Compliance Procedures cont.

- Data Furnishers/Creditors

- Data Furnishers/Creditors have several responsibilities and requirements promulgated under the FCRA at Section 1681s-2(a). Importantly, however, such requirements are not subject to a private right of action/civil liability (see below).

- Rather, a private right of action as to Data Furnishers/Creditors (e.g., credit card companies, collection agencies, noteholders, timeshare developers, etc.) only exists under 15 U.S.C. Section 1681s-2(b).

- Upon receipt of notice of a dispute from a CRA, a Data Furnisher/Creditor must:

- Conduct a reasonable re-investigation with respect to the disputed info;

- Review all relevant information provided by the CRA; and

- Report the results of the investigation to the CRA.

- If information is found to be inaccurate or can no longer be verified, the Data Furnisher/Creditor must: modify that item of information; delete the inaccurate information; or permanently block the reporting of that item of information.

Civil Liability/Private Right of Action - $$$

- Consumers may bring a private right of action against CRAs for negligent or willful noncompliance with any requirement imposed by the FCRA.

- Consumers may bring a private right of action against Data Furnishers/Creditors for negligent or willful noncompliance with only 15 U.S.C. Section1681s-2(b). That is, a private right of action is only available against a Data Furnisher/Creditor if: 1) the consumer first disputed the information with the CRA; 2) the CRA communicated the dispute to the Data Furnisher/Creditor; and 3) the Data Furnisher/Creditor failed to perform a reasonable investigation.

- Negligent noncompliance—15 U.S.C. Section 1681o—provides for actual damages, attorneys’ fees, and costs.

- Willful noncompliance—15 U.S.C. Section 1681n—provides for actual damages, statutory damages between $100-$1,000, punitive damages, attorneys’ fees, and costs. In Safeco Ins. Co. of America v. Burr, the Supreme Court held that willfulness under the FCRA requires a plaintiff to show that the defendant’s conduct was intentional or reckless, where “reckless” consists of “action entailing an unjustifiably high risk of harm that is either known or so obvious that it should be known.”

Common Credit Reporting Errors and What to Look Out For

Unfortunately, the “elaborate mechanism” created by the credit reporting industry is inherently flawed. Far too often, errors in consumer credit reports lead to mistakes in credit scores, and mistakes in credit scores lead to paying too much for credit or being denied credit altogether.

Common Credit Reporting Errors and What to Look Out for with Consumer Bankruptcy Clients:

- Failing to report that a debt was discharged in bankruptcy: Once a debt has been discharged in bankruptcy, the Data Furnisher and CRA must report it as accurately discharged. However, discharged debts are often incorrectly reported as “Charged Off” or “Closed by Credit Grantor.” If a consumer client files bankruptcy, we should follow-up in 3-6 months after discharge to review credit reports for these types of errors/FCRA violations. We settled a similar case just yesterday for $95,000!

- Reporting old debts as new or re-aged: For the most part, negative reporting items may only remain on a credit report for 7 years. Far too often, however, Data Furnishers “re-age” debts by reporting accounts as newly-defaulted or with different/new account numbers. Another common example of this type of violation is reporting the status/negative date as the date of a foreclosure or charge-off, rather than the date of the first delinquency. For all consumer clients, any negative reporting of a tradeline account should be removed from a credit report 7 years after the client last made payment.

- Reporting an account as active when it was closed: Once a consumer voluntarily closes an account—or if CDA PA or Swift Law negotiate a settlement—it must be reported as such by the Data Furnisher and CRAs. However, the CRAs often continue to report closed accounts as active, delinquent, and past-due which harms the consumer’s credit score. Once a debt is settled—e.g., Thorpe law settles a foreclosure lawsuit with a deficiency waiver—the account must be reported as closed with a $0 balance.

- Listing a consumer as a debtor on an account when the consumer was only an authorized user: In order for a debt to be on a consumer’s credit report, that consumer must either have been the account holder or a joint account holder (also referred to as a “co-maker”). If a consumer client is only an authorized user of an account (e.g., on a credit card of a spouse or parent), it is a violation of the FCRA to report the debt on that client’s credit file. When a debt is discharged, it is not uncommon for the account/debt to be opened as a “new” account tradeline on the authorized user’s credit reports.

- Failing to list an account as disputed: Once a consumer disputes a debt to a Data Furnisher or CRA, the CRA must report the debt as disputed. Failing to do so, after a dispute has been sent to the CRA, is a violation of the FCRA. Also, if an attorney sends a dispute and verification/validation letter to a creditor or debt collector, they must report the debt as disputed to the CRAs.

- Impermissible Credit Pulls: When a creditor, landlord, employer, timeshare company, etc. pulls a consumer’s credit without a permissible purpose, it is an FCRA violation. For example, once a debt is settled or discharged in bankruptcy, the Data Furnisher may no longer access the client’s credit report (even for a “soft pull” account review) because there is no longer a legitimate business need for the information as the account is closed.

- Inaccurate Status after Bankruptcy Chapter Conversion: When a debtor converts from a Chapter 13 to a Chapter 7 bankruptcy, creditors and CRAs almost always screw up the credit reporting. These cases are also ripe for debt collection violations.

- Mortgage Servicing Change Mid-Bankruptcy: When there is a change in mortgage servicer mid-bankruptcy—particularly in Chapter 13 cases—the new servicer almost always screws up the credit reporting after on-boarding the loan. CRAs often inaccurately report the bankruptcy information, and creditors receiving payments from the Chapter 13 trustee rarely properly report the payments, balance, and status. Just like above, these cases are also ripe for debt collection violations.

FCRA Dispute Process

FCRA Dispute Standards

- In order to start the FCRA dispute process, it is of paramount importance to understand the requisite error/inaccuracy standards which give rise to valid disputes (and thus valid lawsuits):

- Objectively verifiable inaccuracy: Objectively verifiable, factually incorrect information is “inaccurate” for purposes of the FCRA. Examples: reporting a settled account as past-due/open; reporting discharged account as having a balance pwed; reporting the date of first delinquency as the date of the charge off or foreclosure; reporting a trade-line twice.

- Technically Accurate but Materially Misleading: “And we agree with the three Courts of Appeals to have considered the question that even if the information is technically correct, it may nonetheless be inaccurate if, through omission, it “create[s] a materially misleading impression.” Saunders v. Branch Banking & Trust Co. of Va., 526 F.3d 142, 148 (4th Cir. 2008); see also Boggio, 696 F.3d at 617; Gorman, 584 F.3d at 1163. Whether technically accurate information was “‘misleading in such a way and to such an extent that [it] can be expected to have an adverse effect’” is generally a question to be submitted to the jury. Gorman, 584 F.3d at 1163 (quoting Saunders, 526 F.3d at 150). Examples: reporting a medical debt as late and unpaid when an insurance company failed to pay its contractual obligation; reporting a delinquency when the failure to pay was caused by the creditor (e.g., payment credited to an incorrect account).

FCRA Dispute Process:

- A consumer may dispute inaccurate information in a variety of ways (via telephone, online, letter). A letter—sent certified mail RRR—is always the best. Always CC the creditor as well, and depending on the stage of the dispute process and the client’s goals, send supporting documentation.

- Upon receipt of the dispute, the CRA has 30 days to respond with the re-investigation results (or 45, if the consumer used a free report to initiate the dispute).

- The credit reporting industry automated the dispute investigation process via e-Oscar, a web-based platform used by nearly every CRA and Data Furnisher. E-Oscar facilitates the transmission of Automated Credit Dispute Verifications (ACDVs) and Automated Universal Data-forms (AUDs) between Data Furnishers and the CRAs.

- In a nutshell, it is the use of e-Oscar, ACDVs, and AUDs that form the basis for the general failure of the FCRA dispute process. 80%+ dispute investigation results return with an account as “verified” regardless of the merits of the dispute.